Life insurance is a bedrock of financial planning, designed to protect the people you love most. It steps in when you cannot, providing a financial safety net for your family if you pass away. Imagine the emotional pain of losing someone close; without life insurance, your loved ones might also face a heavy financial strain.

Many people find life insurance confusing, or even a bit scary. You might hear myths about it being too expensive or too complicated to understand. This article cuts through the noise, clearing up common misunderstandings and making the process feel much simpler.

Our goal here is simple: to arm you with the clear, correct information you need to make smart choices about buying life insurance. You’ll learn the basics, explore your options, and discover how to pick a policy that fits your life perfectly.

Understanding the Basics of Life Insurance

What is Life Insurance and How Does It Work?

Life insurance is a contract between you and an insurance company. You pay regular payments, called premiums, and in return, the company promises to pay a sum of money to your chosen loved ones if you die. This payout, known as the death benefit, helps your family cover their living costs, debts, or future plans. It offers a vital financial cushion during a difficult time.

Key Terms You Need to Know

When you look into life insurance, you’ll hear some important words. Here’s a quick rundown of what they mean:

- Policyholder: This is you, the person who buys the policy and pays the premiums.

- Beneficiary: These are the people or organizations you name to receive the death benefit when you die. It could be your spouse, children, or a charity.

- Premium: This is the amount of money you pay regularly to the insurance company to keep your policy active. Premiums can be paid monthly, quarterly, or yearly.

- Death Benefit: This is the tax-free money the insurance company pays to your beneficiaries after your death.

- Underwriting: This is the process where the insurance company looks at your health, lifestyle, and other factors to decide if they’ll offer you a policy and how much your premiums will be.

- Rider: These are extra features you can add to your policy for an additional cost. Riders can offer benefits like critical illness coverage or the option to increase your death benefit later on.

Types of Life Insurance: Which is Right for You?

Choosing the right type of life insurance means looking at your financial goals and how long you need coverage. Each kind offers different benefits and fits various situations. Understanding these options is a big step to protecting your family’s future.

Term Life Insurance Explained

Life Insurance Term life insurance is like renting coverage; it lasts for a specific period, or “term.” Common term lengths are 10, 20, or 30 years. It’s often the most affordable option, great for covering big, temporary needs like paying off a mortgage or providing for young children until they’re grown. If you die within the policy’s term, your beneficiaries receive the death benefit. Many term policies can also be converted into permanent coverage later on, offering more flexibility down the road.

Permanent Life Insurance Options

Permanent life insurance stays with you for your whole life, as long as you pay the premiums. These policies also build up “cash value” over time, which you can often borrow against or withdraw.

- Whole Life Insurance: This type offers lifelong coverage with premiums that stay the same for your entire life. It also has a guaranteed cash value that grows at a fixed rate, and you can access this money during your lifetime. Whole life provides stability and predictability for long-term financial planning.

- Universal Life Insurance: Universal life offers more flexibility compared to whole life. You can often adjust your premium payments and even your death benefit amount over time. Its cash value growth might vary, often linked to current interest rates, giving it both potential and some variability. This policy can adapt as your financial needs change.

- Variable Life Insurance: This type of permanent insurance includes an investment component. A portion of your premium goes into sub-accounts that invest in stocks, bonds, or money market funds. This offers the potential for higher cash value growth, but it also carries more risk because the investment returns are not guaranteed. Your policy’s cash value can go up or down depending on market performance.

How Much Life Insurance Do You Actually Need?

Figuring out the right amount of life insurance can feel daunting. There isn’t a one-size-fits-all answer. Your coverage needs depend on many parts of your life, from who depends on you to how much debt you carry.

The “DIME” Method and Other Calculation Strategies

A helpful way to estimate your coverage needs is the DIME method:

- Debt: Add up all your debts, like credit cards, car loans, and student loans.

- Income: Multiply your annual income by the number of years your family would need support, maybe 5 to 10 years.

- Mortgage: Include the full outstanding balance of your home loan.

- Education: Factor in future college costs for your children.

Adding these figures gives you a solid starting point for your coverage amount. Another common approach is to simply get coverage equal to 7 to 10 times your annual income. Think about your family’s daily needs and long-term goals.

Factors Influencing Your Coverage Needs

Several personal factors will shape how much life insurance you should get. Your age matters; younger people might need more coverage to protect a growing family. Your income, and how many people rely on it, is a huge factor. Existing debts, like a mortgage or car payments, also need to be covered. Finally, consider your financial goals, such as saving for retirement for your spouse or leaving an inheritance. All these pieces come together to show your true coverage needs.

The Application and Underwriting Process

Applying for life insurance involves sharing personal information with the insurance company. This process helps them understand your risk level and offer you a fair premium. It’s a standard part of getting coverage.

What to Expect During the Application

Life Insurance When you apply, you’ll need to provide details about your personal history, including your birth date, job, and marital status. You’ll also answer questions about your medical history, such as any past illnesses, current medications, or family health issues. Expect to share some financial information as well. It’s super important to be completely honest on your application. Misleading information could cause problems later, possibly even stopping your beneficiaries from getting the death benefit.

Understanding Underwriting and Medical Exams

Underwriting is the insurance company’s way of evaluating your risk. They look at all the info you provided to decide if they can offer you a policy and at what cost. This process often includes a medical exam, which is typically free and happens at your home or office. A nurse might take your blood pressure, measure your height and weight, and collect blood and urine samples. Your health status, revealed through this exam, directly impacts your premium. Being prepared to give accurate and full information helps speed up this part of the process.

Factors Affecting Your Life Insurance Premiums

The cost of your life insurance policy isn’t random. Many things influence how much you’ll pay each month or year. Understanding these factors can help you find ways to get a better rate.

Age and Health: The Biggest Drivers

Your age and health are the most important factors in setting your premiums. Generally, younger people pay less for life insurance because they’re seen as lower risk. Someone in their 30s will likely pay less than someone in their 50s for the same amount of coverage. Your health is also key. For example, a healthy non-smoker might get a “preferred plus” rating, leading to much lower rates compared to someone with high blood pressure, who might get a “standard” rating. Good health habits can truly save you money over time.

Lifestyle and Habits

Your everyday life choices also play a part. Smoking, for instance, significantly increases premiums because it’s linked to higher health risks. Engaging in dangerous hobbies, such as skydiving or rock climbing, can also make your policy more expensive. Even your driving record can affect rates, as a history of serious traffic violations might indicate a higher risk. Insurance companies look at anything that could shorten your life expectancy.

Policy Type and Coverage Amount

The kind of policy you choose makes a big difference in cost. Term life insurance is typically more affordable than permanent options like whole life or universal life. This is because term policies only cover you for a set number of years and don’t build cash value. Also, the larger the death benefit you want, the higher your premiums will be. A $1 million policy will always cost more than a $250,000 policy, all else being equal.

Making the Right Choice and What Happens Next

Choosing a life insurance policy is a big decision, but it doesn’t have to be hard. With the right steps, you can find a plan that works for your family and budget.

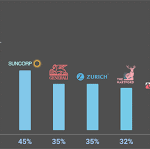

Comparing Quotes and Policies

Don’t settle for the first offer you receive. It is smart to shop around and get quotes from several different insurance companies. Look beyond just the premium price; read the fine print. Carefully review the policy’s terms and conditions, understanding what’s covered and any exclusions. You should also check the financial strength of the insurer. A strong company means they can pay out claims when needed.

Working with an Insurance Agent or Broker

Navigating the many options can feel overwhelming, so consider getting help. An independent insurance agent or broker can be a great asset. They work with multiple companies and can help you compare different policies that fit your needs. As independent insurance advisor Sarah Jenkins often says, “A good agent doesn’t just sell you a policy; they help you buy peace of mind.” They can explain complex terms and guide you through the application process.

What to Do After Your Policy is Approved

Once your life insurance policy is approved, there are a couple of important final steps. First, carefully read through all the policy documents. Make sure everything is correct, especially your beneficiaries’ names. Second, tell your beneficiaries that you have a policy and where they can find the documents. This ensures they know what to do if the time ever comes.

Conclusion

Life insurance is a core part of protecting your family’s financial future. It offers peace of mind, knowing your loved ones will be cared for even if you’re gone. Understanding the different kinds of policies and knowing how to calculate your personal needs are vital first steps in this journey.

An informed decision, thorough comparison of your options, and an honest application process lead to the best outcomes. Do not delay in securing your family’s future. Take the next step today to explore your life insurance options and build a strong financial safety net.