Best Health Insurance Picture this: Your kid falls off the bike during a family picnic. A trip to the ER follows. Without solid health insurance, those bills stack up fast. Healthcare costs in the USA keep climbing. Reports from the Kaiser Family Foundation show average family premiums topped $22,000 a year in 2023. That’s a heavy load for most households.

Family health insurance steps in to ease that worry. It covers check-ups, shots, and surprise illnesses for everyone from babies to parents. You get peace of mind knowing preventive care and emergencies stay affordable. This guide breaks down plan types, top companies, key choices, and smart picks. You’ll learn how to find coverage that fits your crew and cuts costs. Let’s dive in and build your family’s safety net.

Understanding Family Health Insurance Basics

Family health insurance covers medical needs for you, your spouse, and kids under one policy. It beats buying separate plans for each person. In the USA, options range from employer plans to marketplace buys. You qualify if you’re a US citizen or legal resident. Kids up to age 26 often stay on parents’ policies.

Benefits include free yearly check-ups under the Affordable Care Act. Mental health support matches physical care coverage. Dental and vision add-ons help with braces or glasses. Start enrollment at Healthcare.gov. Enter your zip code and family details to see plans. Apply during open periods to lock in rates.

Types of Health Insurance Plans Available for Families

Health Maintenance Organizations (HMOs) keep costs low. You pick a main doctor and stay in-network for care. That’s great for families with routine kid visits. But referrals slow things down for specialists.

Preferred Provider Organizations (PPOs) offer more freedom. See any doctor, but pay less in-network. Families love this for pediatric specialists across town. Drawback: Higher premiums hit your wallet upfront.

Exclusive Provider Organizations (EPOs) mix HMO savings with PPO choice. No out-of-network coverage except emergencies. Point of Service (POS) plans need referrals but allow some outside visits. High-Deductible Health Plans (HDHPs) pair with savings accounts. They suit healthy families saving for big needs.

ACA plans split into Bronze, Silver, Gold, and Platinum. Bronze has low premiums but high out-of-pocket hits. Platinum covers most costs from day one. Use eHealth or Healthcare.gov tools. Plug in your family size to compare. Match needs like frequent doctor trips.

Coverage Essentials for Family Members

Every plan must cover preventive services for free. Think flu shots, cancer screens, and well-baby visits. Maternity care includes prenatal checks and delivery. Pediatric dental and vision handle teeth cleanings and eye exams for kids.

Adults get the same basics, but kids often need more like vaccines. Mental health parity means equal coverage for therapy as for broken bones. All plans cover pre-existing conditions thanks to the ACA. No one gets turned away.

Check your plan details. Call the insurer to confirm kid-specific perks. Look for extras like autism therapy. This ensures full protection for growing families.

Enrollment Periods and Eligibility Rules

Open Enrollment runs from November 1 to January 15 in most states. Sign up then for coverage starting January 1. Miss it? Wait for a Special Enrollment Period. Things like losing a job, having a baby, or moving trigger these windows.

Employer plans start when you hire on or during annual sign-up. Individual plans come via marketplaces or direct from companies. Low-income families check Medicaid or CHIP. These free or low-cost options cover kids first.

State rules vary, so search your area’s site. Use the federal poverty level tool online. Enter income and household size to see subsidy fits. This helps you grab help fast.

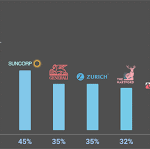

Top Health Insurance Providers for Families

Big names lead in family coverage across the USA. They offer wide networks and kid-focused tools. U.S. News & World Report ranks them high for satisfaction. J.D. Power scores show strong customer service.

Nationwide reach matters for moving families. Look for high NCQA ratings on care quality. Family plans often include apps for tracking appointments. Compare with tables below for quick views.

| Provider | Average Family Premium (2023) | Key Family Feature | Customer Score (J.D. Power) |

|---|---|---|---|

| UnitedHealthcare | $20,500 | Telehealth for kids | 710 |

| Blue Cross Blue Shield | $21,200 | Pediatric networks | 725 |

| Aetna | $19,800 | Wellness rewards | 695 |

| Kaiser Permanente | $18,900 (CA-focused) | All-in-one clinics | 740 |

This table spots differences at a glance. Pick based on your state.

Leading Providers and Their Family Plans

UnitedHealthcare serves over 49 million. Their family plans include 24/7 nurse lines for worried parents. Kids get virtual visits for colds. Check NCQA for top marks in child care.

Blue Cross Blue Shield covers 110 million members. Local plans adapt to your area. Family perks feature free baby classes and dental bundles. It’s a go-to for nationwide moves.

Best Health Insurance Aetna shines with rewards for healthy habits. Earn points for check-ups, redeem for gift cards. Their app tracks family immunizations easily. Strong in mental health for teens.

Kaiser Permanente integrates doctors and hospitals. In nine states, families visit one spot for all needs. Pediatric teams handle everything from births to sports injuries. High satisfaction comes from quick care.

Read reviews on each site. Test their family portals for ease.

Comparing Costs and Benefits Across Providers

Family premiums average $6,575 from your pocket in employer plans, per KFF 2023 data. Deductibles hover at $3,000 for many. Copays run $20-50 per visit. Silver plans balance these with subsidies.

Premium tax credits cut bills if income fits ACA caps. A family of four under $100,000 saves big. Use plan finders on sites. Input ages, zip, and income for quotes.

Gold plans cost more upfront but save on big claims. Bronze works for low-use families. Watch out-of-pocket maxes, often $15,000 yearly. Compare apples to apples for true value.

Customer Reviews and Real-World Performance

J.D. Power’s 2023 study ranks Aetna high for claims ease. Families praise quick payouts for ER trips. Blue Cross scores well in app usability. Parents track meds without hassle.

Consumer Reports shares stories of smooth maternity coverage. One mom noted zero surprise bills after birth. UnitedHealthcare gets nods for kid telehealth during flu season. But some gripe about network limits.

Look at app features. Good ones let you manage family accounts in one spot. Share access with spouses for better teamwork.

Key Factors to Consider When Choosing a Plan

Picking family health insurance in the USA means weighing your life. Think about doctor access and budget. Location plays a role—rural spots need wide networks. Health history guides coverage depth.

Use this checklist:

- List family doctors and hospitals.

- Note ongoing needs like asthma meds.

- Budget premiums vs. deductibles.

- Check kid age limits.

This keeps choices clear. Avoid overload by focusing on top needs.

Family Size, Age, and Health Needs

Adding a newborn bumps premiums about 20%. Plans cover from day one with ACA rules. No lifetime caps mean ongoing care for conditions like diabetes stays safe.

Teens need sports injury coverage. Seniors in the family want easy specialist access. Prioritize maternity if planning more kids. Chronic support shines in Gold plans.

Tailor to ages. Young families save with HDHPs. Older ones pick lower deductibles.

Network of Doctors and Hospitals

In-network saves 30-50% on bills. Out-of-network hits hard with balances. Pediatricians top the list for families. Use directories to search your crew’s docs.

Urban areas boast choices. Rural families check for nearby ERs. Verify hospitals for deliveries or surgeries.

Search before you buy. Call to confirm your favorites join the plan.

Additional Benefits and Extras for Families

HSAs with HDHPs let you save pre-tax. Families contribute up to $8,300 in 2024, per IRS. Use for copays or braces.

Gym perks encourage family walks. Virtual care cuts travel for sick days. Bundle dental and vision to skip separate policies.

Hunt for these add-ons. They trim total costs and boost health.

How to Enroll and Maximize Savings

Enrolling in family health insurance starts with your path. Employer? Fill forms at work. Marketplace? Go online. Direct? Call the company.

Gather docs like pay stubs for subsidies. Timelines matter—apply early to beat rushes. Brokers help with tricky spots like blended families.

Savings come from smart picks. Subsidies average $5,000 yearly for qualifiers.

Step-by-Step Enrollment Guide

First, check eligibility. Use Healthcare.gov for marketplace plans.

Second, gather info. Need SSN, income proof, and dependent details.

Third, compare options. Enter family facts for custom quotes.

Fourth, pick and apply. Review summaries before submit.

Fifth, confirm coverage. Get ID cards and start using benefits.

Enroll in Open Enrollment for no gaps. Brokers simplify if you have questions.

Tips for Reducing Premiums and Out-of-Pocket Costs

Qualify for APTC if income stays under 400% of poverty level. It caps costs at 8.5% of pay. HDHPs with HSAs lower premiums; save tax-free.

Appeal wrong denials. CMS says subsidies saved families $700 billion since 2014.

Shop quotes from three providers. Short-term plans bridge gaps, but watch limits.

Common Mistakes to Avoid

Don’t skip Rx coverage if meds run high. Families regret it during illnesses.

Miss deadlines, and you face fines or gaps. Double-check college kids up to 26 qualify.

Underestimate needs. List all family issues first.

Conclusion

Solid family health insurance protects against USA’s high costs. We covered plan types like HMOs and PPOs, top picks from UnitedHealthcare to Kaiser, and factors like networks and perks. Compare with tools, grab subsidies, and enroll smart to save.

The right plan brings calm. No more bill fears during fevers or falls. Head to Healthcare.gov now. Explore options for your family. Take that step for lasting health security.