Health Insurance Imagine facing a doctor’s visit only to get hit with a surprise bill that wipes out your savings. High deductibles often turn routine checkups into financial nightmares for many Americans. A zero-deductible health insurance plan changes that by letting you see providers without paying a big upfront amount each year.

These plans appeal to folks who deal with ongoing health issues or stick to tight budgets. You pay nothing toward a deductible, but other costs like monthly premiums remain. This guide covers where to find zero-deductible options in the USA, who they suit best, and the real costs involved. We’ll break down plan types, trade-offs, and tips to pick the right one for your needs.

Understanding the Zero-Deductible Landscape

Zero-deductible health plans offer a way to access care without that initial hurdle. They fit into the broader world of health coverage in the USA. Let’s explore what makes them work and how they stack up.

What Exactly is a Zero-Deductible Health Plan?

A zero-deductible health plan means you don’t pay any amount out of pocket before your insurance kicks in for covered services. You start getting benefits right away on the first visit. But remember, this doesn’t wipe out all costs—monthly premiums, copays for office visits, and coinsurance for bigger bills still apply.

Think of the deductible as the gatekeeper that holds back coverage until you spend a set amount. With zero-deductible options, that gate stays open from day one. The out-of-pocket maximum caps your total yearly spending, including copays and coinsurance, but not premiums. For example, if your plan has a $2,000 out-of-pocket max, that’s your limit for the year on eligible costs.

Health Insurance These plans shine for predictable budgeting. You know exactly what a primary care visit costs upfront, say $20 copay, without surprises. Still, always check the fine print—some plans apply the zero deductible only to certain services like preventive care.

Common Plan Types Offering Zero-Deductible Features

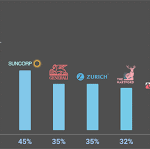

Many zero-deductible plans show up in employer groups or through the ACA Marketplace. Health Maintenance Organizations (HMOs) often lead the pack because they focus on in-network care to keep costs low. Platinum-level plans under the Affordable Care Act also frequently offer this perk, covering about 90% of costs after any copays.

Employer-sponsored plans might bundle zero deductibles for primary and preventive services. Some unions or large companies provide them as perks for full-time workers. In the ACA world, Gold and Platinum tiers are your best bets, though Platinum plans are rare in some states.

Here’s a quick comparison to see the balance:

| Plan Type | Typical Monthly Premium | Deductible | Average Copay for Doctor Visit |

|---|---|---|---|

| Bronze (High Deductible) | $300–$500 | $7,000+ | $50+ or coinsurance |

| Gold | $500–$800 | $1,500 | $20–$40 |

| Platinum (Zero-Deductible) | $800–$1,200 | $0 | $10–$30 |

This table shows how zero-deductible plans trade higher premiums for lower upfront risks. They integrate well with employer benefits or Marketplace subsidies if you qualify.

The Trade-Off: Premiums and Cost-Sharing Mechanisms

You can’t escape higher monthly payments with zero-deductible health insurance plans. Premiums often run 20–50% more than standard options to cover the lack of deductible. That extra cost buys peace of mind, but it adds up over a year.

Copays kick in for most services—$15 for your family doctor, maybe $40 for a specialist. Coinsurance, where you pay a percentage of the bill, might apply to hospital stays or tests. True zero-deductible plans limit coinsurance, but some have it after copays for big claims.

For chronic care users, this setup pays off. A person with asthma avoids a $1,500 deductible hit on inhalers and checkups. But if you skip doctor visits, those premiums feel like wasted money. Weigh your expected health needs against the premium hike before jumping in.

Where to Find Zero-Deductible Health Insurance

Finding these plans takes some digging, but resources exist across the USA. Start with your job or the federal Marketplace. State variations matter, so check local options too.

Employer-Sponsored Group Health Plans

Big companies often roll out zero-deductible coverage to attract talent. Self-insured employers, like those with over 50 workers, design plans that waive deductibles for in-network primary care. Tech firms and manufacturers lead this trend, covering 70% of large employer plans with low or no deductibles, per recent surveys.

If you work for a mid-sized business, ask HR about HMO options. These plans might limit choices to a local network but save on costs. For example, a California employer could offer a zero-deductible HMO for routine visits, keeping your budget steady.

Health Insurance Trends show more employers adding this feature post-pandemic. About 25% of group plans now include zero deductibles for preventive services. If your job offers it, compare the premium contribution—many cover most of the cost.

Navigating the Affordable Care Act (ACA) Marketplace

The ACA sorts plans into metal tiers, and Platinum ones top the list for zero-deductible health insurance in USA. These cover 90% of expenses, with you paying just 10% through copays. Gold plans sometimes dip into zero deductibles too, especially in states like New York or California.

Head to HealthCare.gov during open enrollment, from November to January. Use the plan finder tool to filter by “$0 deductible.” Enter your zip code and income for subsidy estimates—low earners might pay under $100 monthly after help.

Not all states have Platinum plans; only about 20 do. If yours lacks them, look at enhanced Silver plans with cost-sharing reductions. These mimic zero-deductible benefits for eligible folks. Always preview costs for your doctors to avoid network shocks.

Specialized Plans and Short-Term Alternatives (With Caveats)

Health care sharing ministries, like Medi-Share, act like zero-deductible setups by pooling costs among members. You share bills directly, often with no upfront deductible. But they aren’t insurance—pre-existing conditions get limited, and legal protections fall short under ACA rules.

Short-term plans fill gaps but rarely offer true zero deductibles. Some states run pilot programs for low-income groups with no-deductible Medicaid expansions. Stick to compliant options for full coverage; alternatives risk big gaps in emergencies.

These non-standard paths suit healthy people bridging to full plans. Always verify if they count as minimum essential coverage to avoid tax penalties.

Who Benefits Most from Zero-Deductible Coverage

Not everyone needs a zero-deductible plan, but certain groups gain big from the stability. Think about your health habits and finances first.

Individuals with Chronic Conditions Requiring Frequent Care

People with diabetes or heart issues visit doctors often—up to 10 times a year. Zero-deductible plans let them focus on health, not bills. A $0 start means every blood test or therapy session costs just a copay.

Experts say this setup cuts stress and improves outcomes. “Predictable costs help patients stick to treatment plans,” notes one health policy analyst. For someone managing rheumatoid arthritis, avoiding a deductible saves hundreds on specialist fees.

Prescriptions flow easier too, with copays from day one. If you fill meds monthly, this feature offsets the premium fast.

Budget-Conscious Households Prioritizing Monthly Stability

Families on fixed incomes hate surprises. Zero-deductible options keep spending even, like a steady utility bill. You plan for $900 premiums, not a $3,000 deductible spike.

This appeals to single parents or retirees. They budget visits into grocery money without fear. In high-cost areas like Texas cities, it prevents debt from one ER trip.

Stability builds confidence. You seek care early, catching issues before they grow.

Understanding When a Zero-Deductible Plan Doesn’t Make Sense

Young adults in good shape rarely need doctors. A high-deductible plan with low premiums saves cash—pair it with an HSA for tax perks. You might pay $300 monthly versus $900, banking the difference.

If you skip checkups, the extra premium goes unused. Data shows healthy folks under 35 use just 20% of coverage benefits. Stick to Bronze or basic Silver for them.

Weigh risks: emergencies still hit the out-of-pocket max, but lower premiums free up funds for savings.

Evaluating the True Cost: Beyond the Deductible

Look past the zero deductible to get the full picture. Other elements shape your wallet.

Analyzing Out-of-Pocket Maximums and Copay Structures

Every plan has an out-of-pocket max, even zero-deductible ones—often $2,000 to $5,000 yearly. It covers copays and coinsurance, stopping costs cold after you hit it. Compare this number across plans; a low premium with high max hurts more than steady payments.

Copays vary: $10–$20 for primary care, $30–$50 for specialists, $100+ for ER. Tiered systems reward sticking to your doctor. In a PPO zero-deductible plan, out-of-network jumps to full price, so stay in bounds.

Track totals: add premiums to max for yearly cost. A plan with $10,000 premiums and $1,500 max beats $6,000 premiums and $8,000 max if you use care often.

Prescription Drug Coverage (Rx Costs)

Drugs often follow separate rules. Many zero-deductible medical plans still charge a small Rx deductible, like $100. Or they use tiers: $5 generic, $50 brand-name copays from the start.

Check the formulary—your plan’s drug list—for coverage. Insulin or blood pressure pills might cost $0 under preventive rules. But specialty meds for cancer hit higher coinsurance.

Shop around: some plans waive Rx deductibles for chronic needs. This keeps daily costs low for ongoing users.

Network Restrictions: HMO vs. PPO Implications

Zero-deductible plans lean on HMOs for affordability. You pick a primary doctor who coordinates care, all in-network. Step outside, and you pay full freight—no coverage help.

PPOs offer more freedom but cost more in premiums. Out-of-network services might trigger deductibles or 40% coinsurance. In rural areas, HMO networks feel tight, limiting choices.

Balance access: if your specialists are in-network, HMO saves big. Otherwise, pay extra for PPO flexibility.

Conclusion: Making the Final Decision on Predictable Health Spending

Zero-deductible health insurance plans in the USA deliver top predictability at a premium price. They suit frequent care needs but may waste money for the healthy. Key is matching the plan to your life.

- Compare out-of-pocket maximums and copays side by side using tools like HealthCare.gov.

- Assess your health use: chronic conditions favor zero deductibles; rare visits don’t.

- Factor in networks—stick to in-network for max savings.

- Review Rx coverage early to avoid hidden drug costs.

Take action now: plug your details into state Marketplace sites. Enroll during open periods to lock in coverage that fits your budget and health goals. Your peace of mind starts with the right choice.