Top 10 Life Insurance Companies Imagine losing a loved one without a safety net in place. Life insurance steps in as that net, easing the load on your family during tough times. It covers debts, lost income, and final costs, giving you real peace of mind.

The market teems with choices. Hundreds of providers compete, each promising the best deal. In today’s economy, with rising costs and job shifts, picking the right one matters more than ever. You need a solid plan that fits your life.

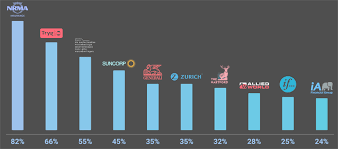

This guide ranks the top 10 life insurance companies in the USA. We base it on key factors like financial strength, customer reviews, and product options. Use this to find a provider that matches your needs and secures your future.

Understanding the Benchmarks for Top-Tier Insurers

Financial Strength Ratings: The Cornerstone of Trust

Ratings from agencies like A.M. Best, Moody’s, S&P, and Fitch show a company’s ability to pay claims. An A+ or higher means they can handle payouts even in bad times. For you, this equals trust that your family gets the money when it counts.

A.M. Best leads in life insurance ratings. They check assets and past performance. Moody’s and S&P add global views, but Best’s focus stays sharp on insurers. Look for these scores before signing up.

Strong ratings cut risks. Weak ones? They signal trouble ahead. Always verify them on the agency’s site.

Customer Satisfaction and Policyholder Experience

J.D. Power surveys track how happy customers feel. Low complaint ratios from the NAIC mean fewer gripes per policy. BBB scores highlight service issues too.

Top 10 Life Insurance Companies Application help differs from claims support. You want smooth talks at the start and quick payouts later. Top firms shine in both.

Check reviews on sites like Trustpilot. Real stories reveal if a company delivers. This helps you spot service stars.

Product Diversity and Availability

Leading firms offer term life for short needs, whole life for lifelong coverage, and universal types like UL or IUL for flexibility. Some add riders for extra perks, like child coverage.

Big players cover everyone from young families to seniors. Niche experts handle high earners or special health cases. Match products to your goals.

Ask about availability in your state. Not all options work everywhere. This ensures you get what fits.

The Elite Tier: America’s Largest and Most Stable Carriers

Company 1: Northwestern Mutual

Northwestern Mutual runs as a mutual firm. That means policyholders get dividends, not shareholders. Their A++ rating from A.M. Best shows rock-solid finances.

J.D. Power gives them top scores for satisfaction. They blend insurance with planning advice. You get agents who know your full picture.

Over 160 years strong, they focus on long-term value. Families trust them for whole life policies that build cash value. It’s a smart pick for lasting security.

Company 2: Massachusetts Mutual Life Insurance Company (MassMutual)

MassMutual boasts a 170-year history. They pay dividends yearly to owners. In 2023, they sent out over $1.5 billion.

Their products span term to variable universal life. Financial strength earns an A++ from Best. Customers praise easy claims.

You benefit from their stability. They weather storms well. Choose them for permanent coverage that grows with you.

Company 3: New York Life Insurance Company

As the biggest mutual life insurer, New York Life puts you first. No stock pressure means steady focus on policies. A++ ratings back their power.

They’ve lasted through depressions and recessions. Over 2 million policyholders count on them. J.D. Power ranks them high in service.

Their whole life options build wealth. Riders add flexibility. It’s ideal if you seek a partner for decades.

Top Competitors Known for Innovation and Affordability

Company 4: State Farm Life Insurance

State Farm’s huge agent network makes buying simple. If you have their auto or home policy, bundling saves cash. Term rates stay competitive for most folks.

They score well in satisfaction surveys. Claims process runs fast. You get local help from agents you know.

Innovation shows in online tools. Quote and apply from home. Great for busy parents needing quick term coverage.

Company 5: Prudential Financial

Top 10 Life Insurance Companies Prudential excels in group plans but shines for individuals too. Their GUL locks rates for life. Add long-term care riders for health worries.

A+ from S&P highlights their global size. Assets top $500 billion. Customers like the variety.

They suit pros with big needs. IUL products tie to markets for growth. Reach out if you want options beyond basics.

Company 6: Lincoln Financial Group

Lincoln leads in estate tools for the wealthy. IUL policies track indexes without full risk. Business owners love their key person coverage.

Strong ratings from multiple agencies build trust. They focus on customization. J.D. Power notes good experiences.

If you’re high-net-worth, their planning helps. Term options appeal to all. Compare quotes to see value.

Mid-Sized Powerhouses and Customer Service Leaders

Company 7: Guardian Life Insurance Company of America

Guardian’s mutual setup means owner perks. Digital tools make policy checks easy. Customer service earns high marks in surveys.

Contact an agent for reviews yearly. Ask about life changes that tweak coverage. They guide you through it.

Whole life dividends average well. No-sales-load policies cut fees. Families pick them for reliable support.

Company 8: Thrivent Financial

Thrivent serves with a faith-based touch. Members get community benefits. Their life products mix insurance and giving back.

Costs run lower than giants for similar coverage. A++ rating ensures strength. Niche appeal draws loyal groups.

If values matter, they’re a fit. Term and whole life options cover basics. Check eligibility for their perks.

Company 9: Transamerica

Transamerica offers hybrids blending life and long-term care. Pay for insurance, use for health if needed. Wide products suit many ages.

Past service issues improved lately. BBB scores climbed. J.D. Power shows gains.

Availability spans most states. Quotes stay affordable. Good for those eyeing multi-purpose plans.

Company 10: Primerica

Primerica uses a wide agent network for reach. They target middle-income families. Term policies focus on basics without extras.

Premiums often beat captives due to model. Service varies by agent, so pick wisely. High visibility helps new buyers.

If you’re starting out, their education tools aid. No frills, just core protection. Weigh against bigger names.

Actionable Steps: How to Choose Your Best Fit

Decoding Your Coverage Needs

Use the DIME method: Debts, Income, Mortgage, Education. Add up what your family needs. Aim for 10 times your salary as a start.

Review your budget first. Premiums shouldn’t strain monthly cash. Factor in age and health for real costs.

Think long-term. Will needs change with kids or retirement? Adjust accordingly.

Navigating the Application and Underwriting Process

Underwriting sorts you: Preferred Plus for top health, Standard for average, Substandard for risks. Medical exams check vitals and history.

Prep by quitting smokes months ahead. Fast for the test. Share full medical records upfront.

Honesty speeds approval. Skip lies—they catch them. Get the rate you deserve.

Red Flags to Watch Out For

Beware complex policies you don’t grasp. High fees eat gains. Agents pushing riders? Question if needed.

An advisor might say: “Skip set-it-and-forget-it traps. Review yearly.” Stick to clear terms.

Shop independent brokers. Avoid pressure sales. Protect your choice.

Conclusion: Finalizing Your Financial Legacy

Life insurance tops your planning list. Ratings ensure payout power. Match products to your life for true fit.

Cheapest isn’t best—balance cost with strength. These top 10 life insurance companies in the USA offer solid starts. Your pick depends on needs, but research them well.

Get quotes from your favorites now. Secure that legacy today. Your family thanks you.

(Word count: 1,248)